e-TDS Returns, Faster

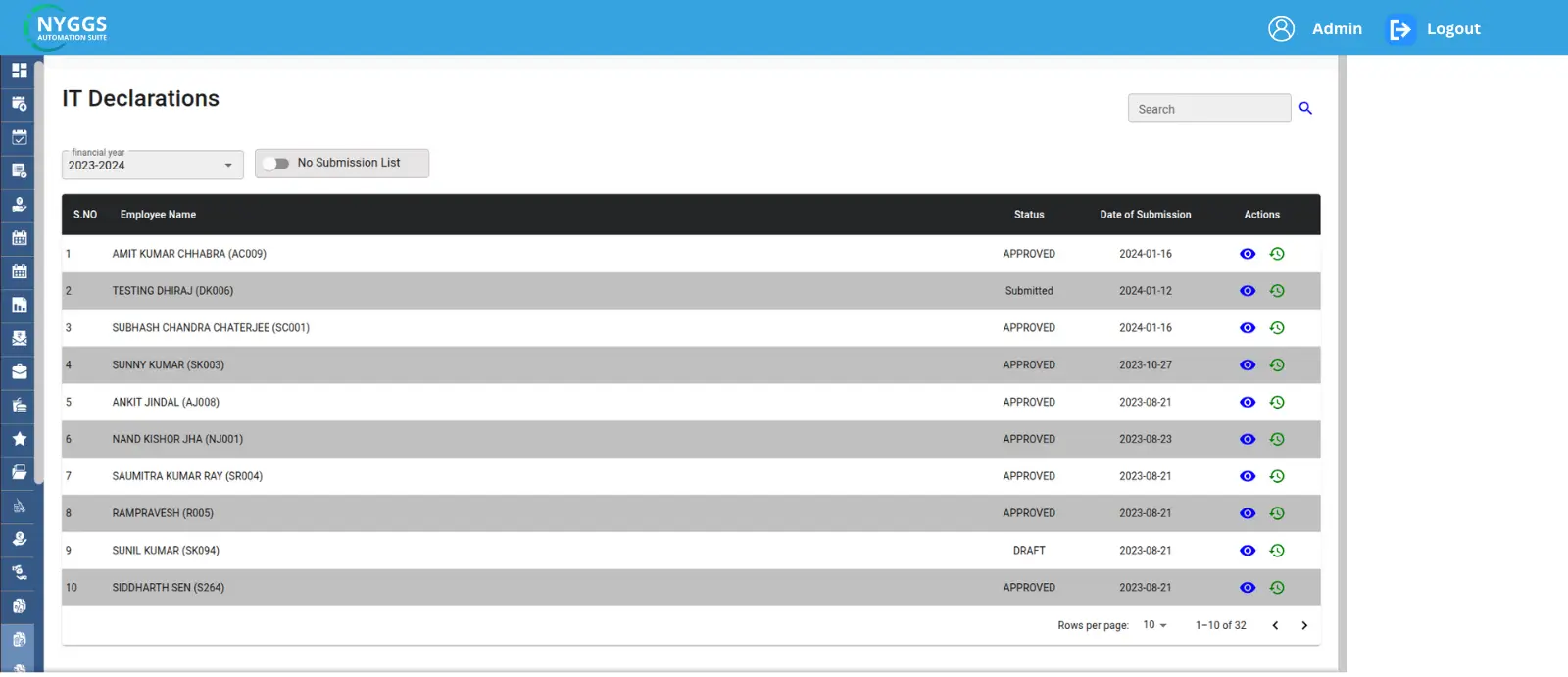

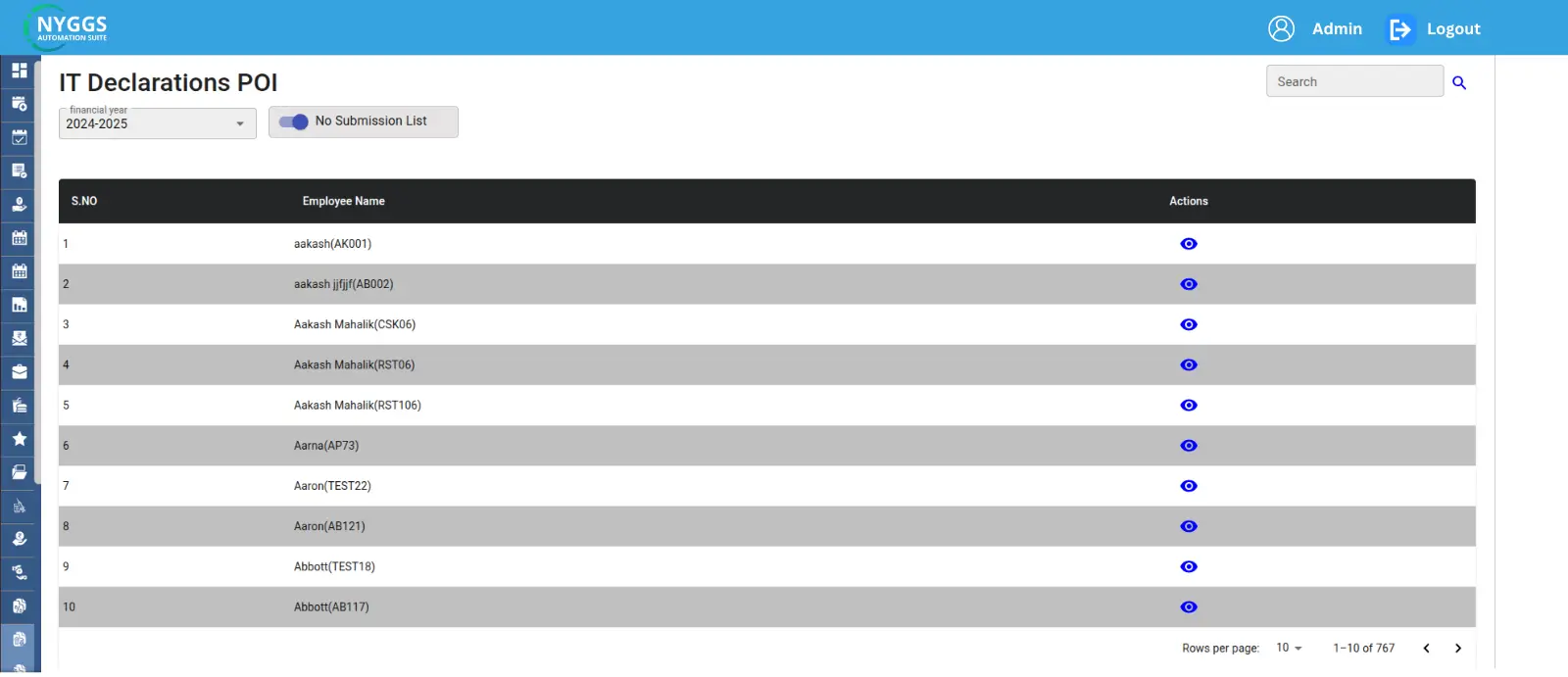

TDS Declaration Software

NYGGS- India's Simplest TDS Declaration Software through the HRMS app. Collect all TDS documents in 3 clicks. One app error-free calculations and compliance for all your e-TDS needs.