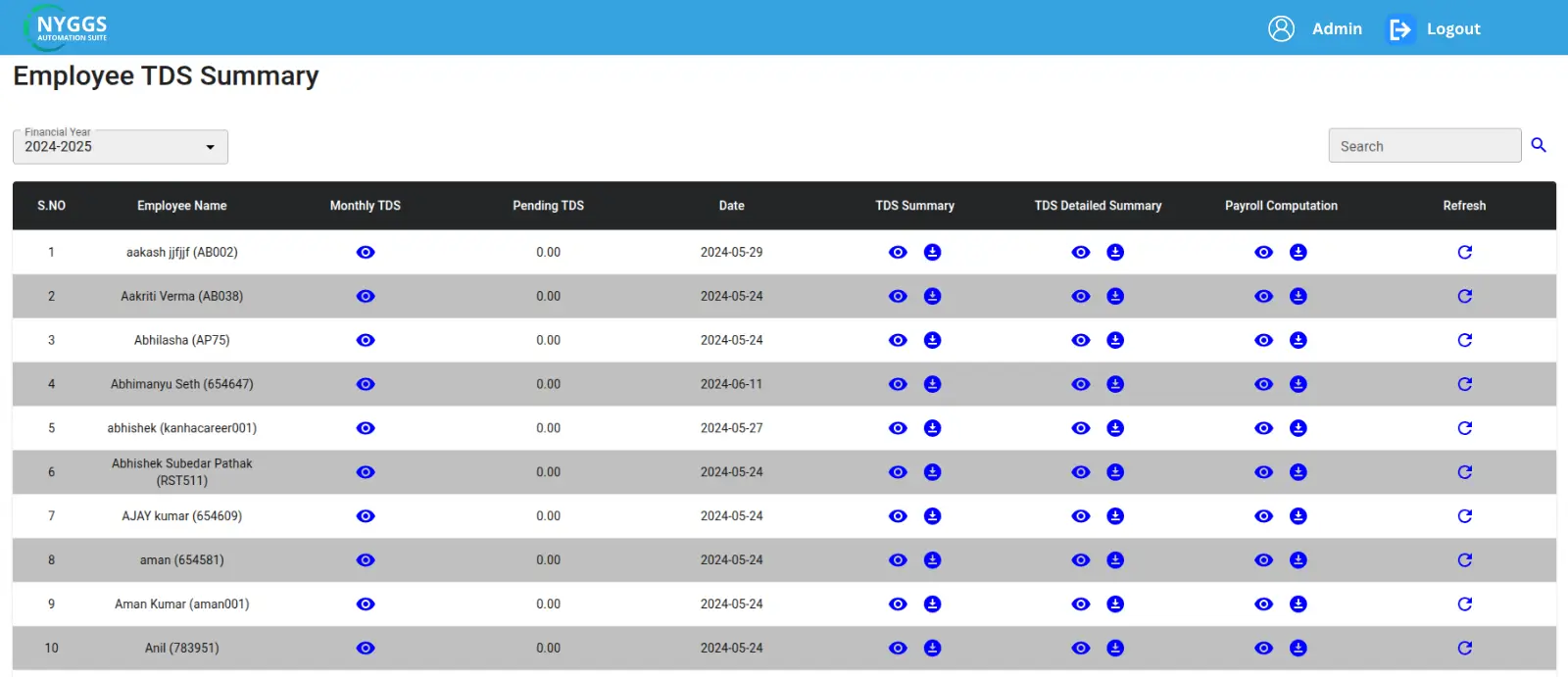

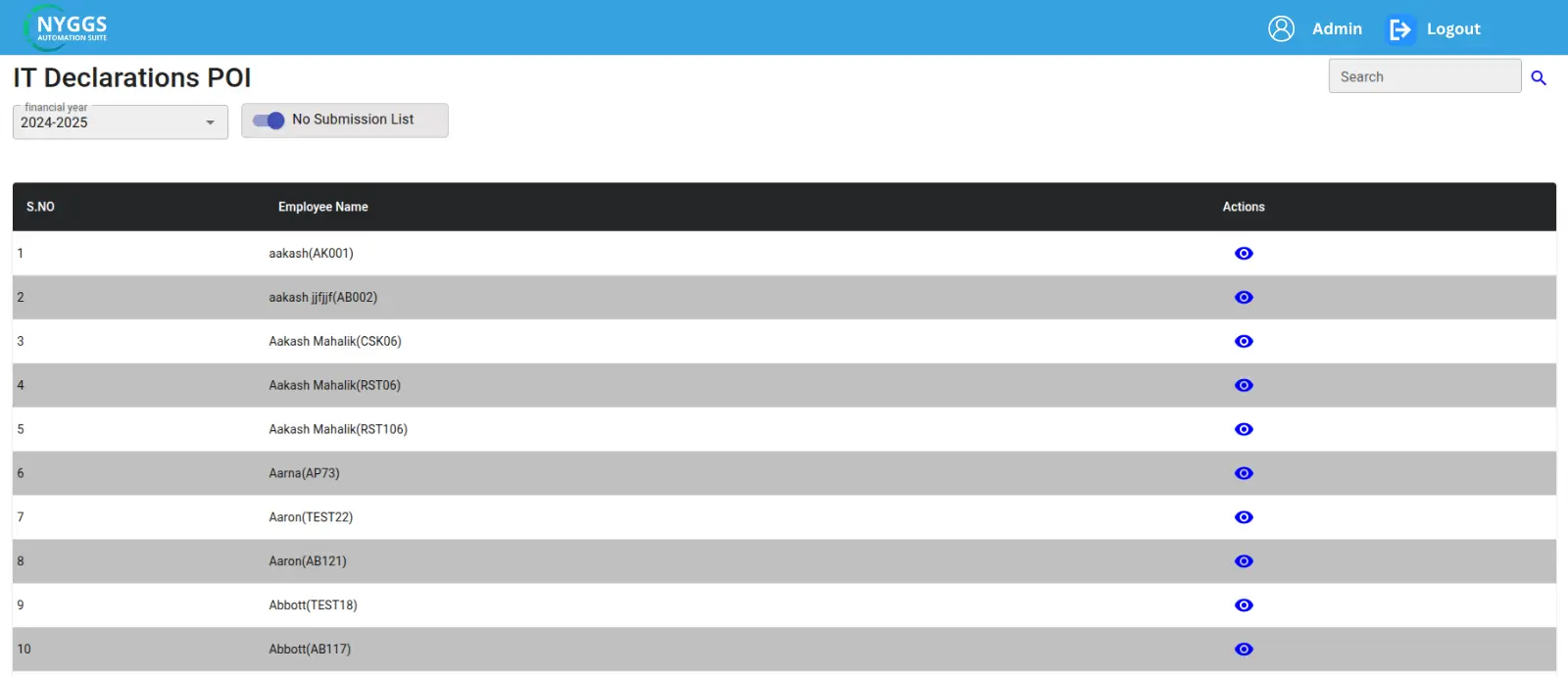

Simplify Your Taxation Process

Taxation Software

Implement the payroll tax management software to resolve all the hurdles of taxation tasks in one go for your organization. Stay updated with the digitally automated industries.