An employee salary certificate is a concise, official HR letter that confirms exact monthly or annual earnings by employee. The purpose? The employee needs it to share with banks, lenders, landlords, or visa officers for obvious reasons.

Table of Contents

ToggleThis blog gives HR teams in India a practical, ready-to-use salary certificate format and a template you can adapt instantly.

Read this quick guide on how to write clear salary certificates as well as use the template to provide compliant proof of income every time.

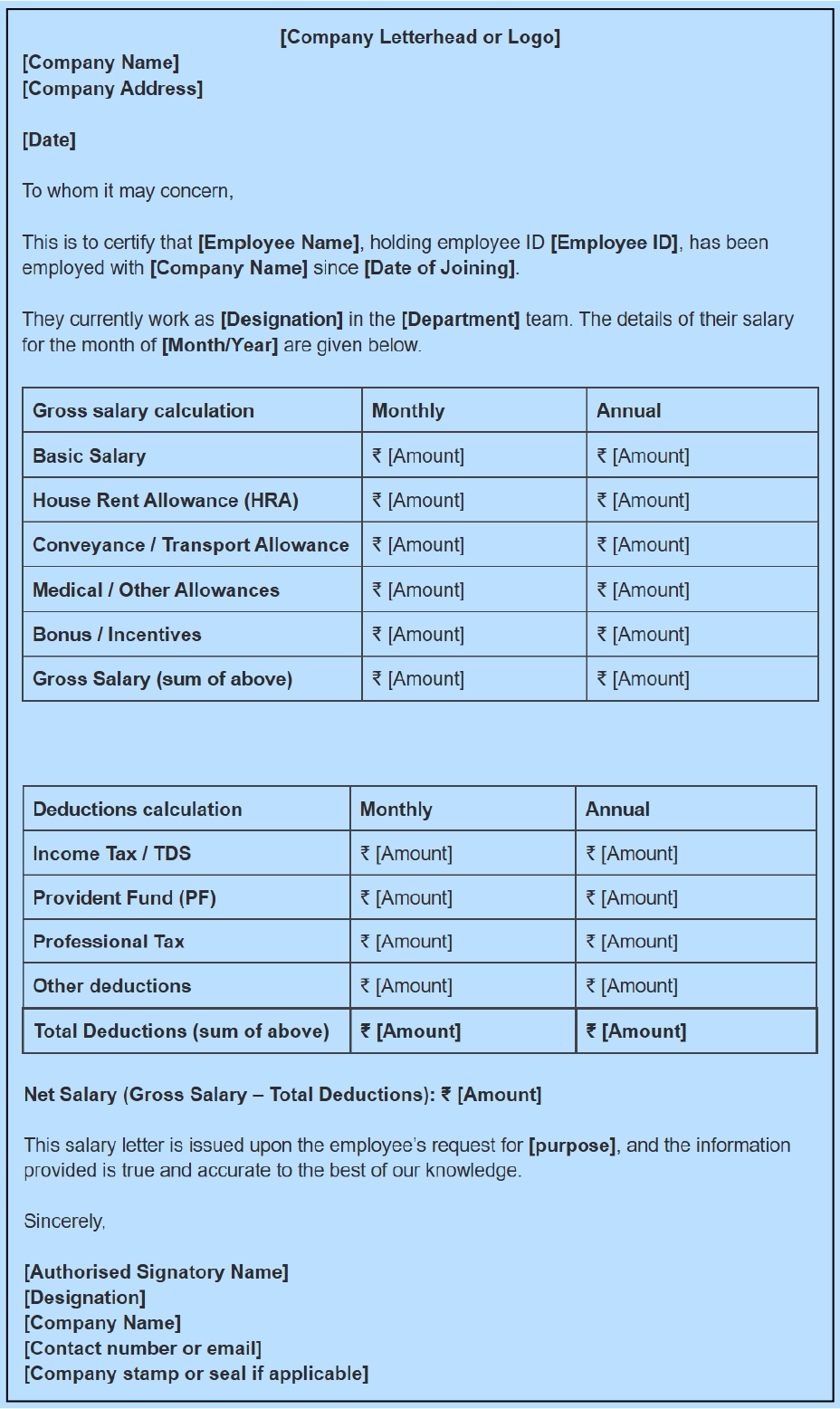

Employee Salary Certificate Format

Apply this structure whenever an employee asks for a salary certificate. Speed up the process as well as cut follow-up queries.

Company details

- Provide the employer’s legal name and address.

- Add a contact number or email.

- It’s better to use a company’s letterhead.

Employee details

- State the employee’s full name and employee ID.

- Specify designation and department.

- Include the residential address.

Employment details

- Enter the date of joining.

- Note the current employment status, for example, full-time or part time.

Salary breakdown

- List each component on its own line: basic pay, dearness allowance, HRA.

- Include travel allowance, medical, travel, and any special perks.

- Present gross salary as the sum of components.

Specify deductions

- Itemise statutory deductions such as PF, professional tax, and LWF.

- Include TDS and insurance contributions.

- Add any other voluntary deductions.

Disclose net salary

- Declare the final take-home amount (monthly and annually).

Purpose and Declaration

- Write the purpose of the certificate if relevant.

- Add a short statement that the details are true and correct.

- Provide the authorised signer’s name and designation.

Employee Salary Certificate Format + Template

|

[Company Letterhead or Logo] [Company Name] [Company Address]

[Date]

To whom it may concern,

This is to certify that [Employee Name], holding employee ID [Employee ID], has been employed with [Company Name] since [Date of Joining].

They currently work as [Designation] in the [Department] team. The details of their salary for the month of [Month/Year] are given below.

This salary letter is issued upon the employee’s request for [purpose], and the information provided is true and accurate to the best of our knowledge.

Sincerely,

[Authorised Signatory Name] [Designation] [Company Name] [Contact number or email] [Company stamp or seal if applicable] |

Sample Salary Certificate Format (Word)

|

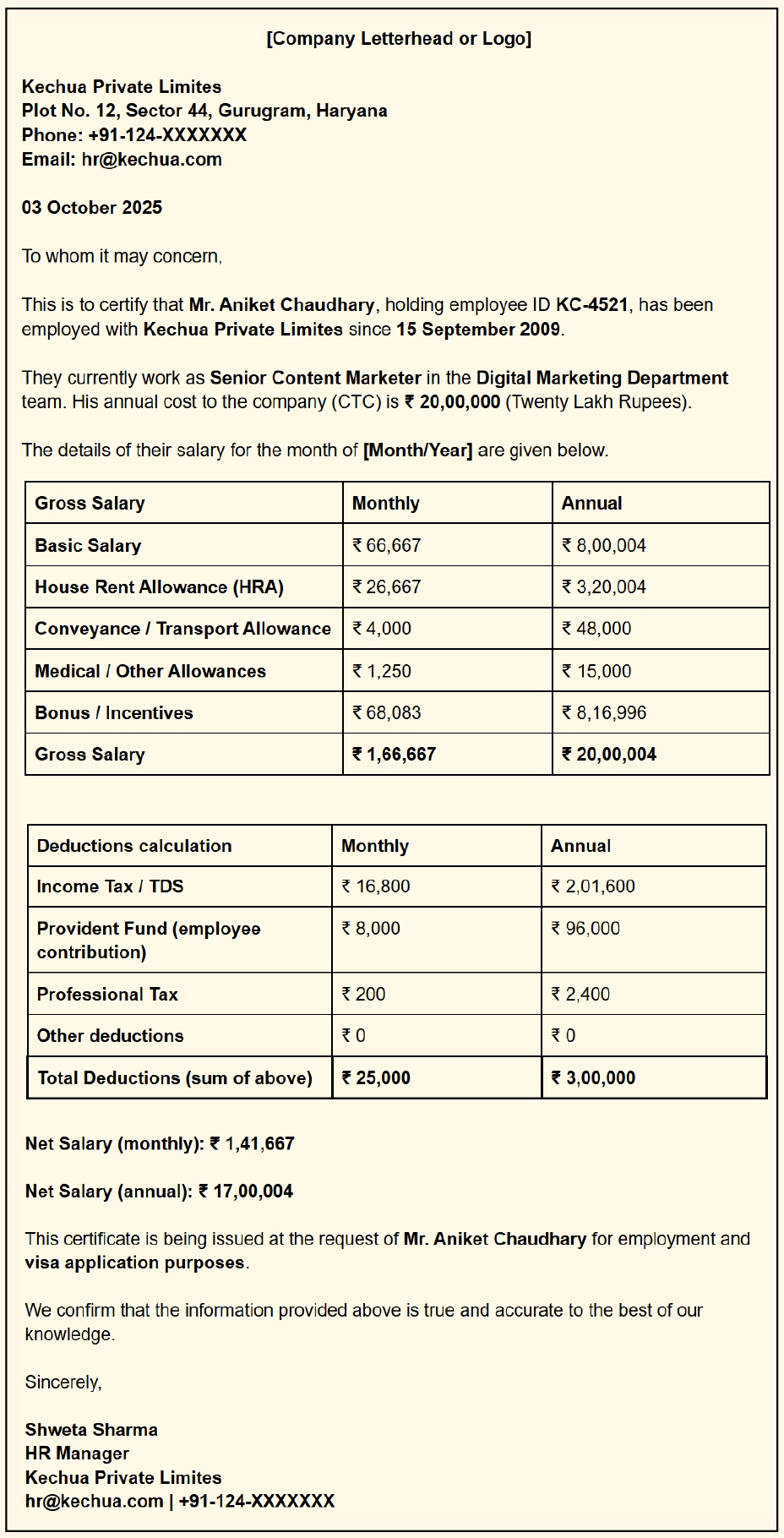

[Company Letterhead or Logo]

Kechua Private Limites Plot No. 12, Sector 44, Gurugram, Haryana Phone: +91-124-XXXXXXX Email: hr@kechua.com

03 October 2025

To whom it may concern,

This is to certify that Mr. Aniket Chaudhary, holding employee ID KC-4521, has been employed with Kechua Private Limites since 15 September 2009.

They currently work as Senior Content Marketer in the Digital Marketing Department team. His annual cost to the company (CTC) is ₹ 20,00,000 (Twenty Lakh Rupees).

The details of their salary for the month of [Month/Year] are given below.

Net Salary (monthly): ₹ 1,41,667

Net Salary (annual): ₹ 17,00,004

This certificate is being issued at the request of Mr. Aniket Chaudhary for employment and visa application purposes.

We confirm that the information provided above is true and accurate to the best of our knowledge.

Sincerely,

Shweta Sharma HR Manager Kechua Private Limites hr@nyggs.com | +91-124-XXXXXXX |

Salary Certificate vs Salary Slip

Both documents show what an employee earns, but they serve different functions and audiences. One is a formal attestation for outside parties. The other is a routine payroll record for the employee.

Purpose

A salary certificate is a concise proof of income and employment used by banks, landlords, and visa officers. A salary slip records salary components and deductions and proves that payment was made.

Detail level

Certificates present high-level totals and a short declaration. Slips break down every component: basic, HRA, allowances, gross, deductions, and net pay.

Frequency

Salary certificates are issued on request or for specific needs. Slips are generated every payroll cycle, typically monthly.

Legal and administrative weight

Salary slips support statutory compliance and payroll audits. An employee salary certificate carries weight for external verification but is not a substitute for payroll records.

When to use which

Provide a certificate when an employee requests income verification for loans, visas, or tenancy. Share salary slips for salary queries, tax filing, or internal reconciliations.

Clear, accurate certificates reduce delays. Detailed slips prevent payroll disputes. Use both correctly to streamline HR operations.

NYGGS HRMS for Salary Certificate Automated Writing

At first, an employee salary certificate letter might look like a one-page formality. But for the employee, it’s proof of income and an impression in front of a third party. document.

However, writing a salary certificate doesn’t have to be time-consuming every time.

With NYGGS HRMS Software, you can generate all the HR letters—salary certificates, experience certificates, relieving letters, and offer letters—all in a few clicks. It even comes with a pre-loaded salary certificate format and other HR letter templates so you’re never starting from scratch.

Automate tasks. Save time. And always look professional.

Because a good HR process doesn’t just serve the company; it earns trust, even in the outside world.

Contact us for a personalised demo to know how NYGGS HRMS will work for you.